Scope Ratings today announced that its public ratings and a wide range of subscription ratings are now available to Bloomberg customers via the Credit Profile {CRPR<GO>}, Rating Changes {RATC<GO>}, and News Headlines {NH SCP<GO>}, solutions on the Bloomberg Terminal. Customers can also access Scope’s ratings for enterprise use via Bloomberg’s Data License and real-time market data feed, B-PIPE.

This collaboration allows Bloomberg customers around the globe to efficiently access the ratings of the leading European credit rating agency, ultimately facilitating much wider use of Scope’s credit views by investors, enhancing their management of credit risk while providing greater diversity of credit opinion for fixed-income markets.

“Investors all over the world use Bloomberg to access financial data and credit ratings. We are therefore delighted that Bloomberg is now publishing and distributing Scope’s ratings. Availability via Bloomberg’s solutions will allow a much broader use of our ratings by investors, good news not just for us at Scope but also for issuers and credit markets in general for which a diversity of credit opinion is crucial,” said Marc Lefèvre, Head of Investor Outreach at Scope Group.

“We offer an independent European rating voice to investors seeking to diversify the use of their ratings and make them less dependent on US providers. Following soon after the ECB’s acceptance of our credit ratings, Bloomberg's decision to publish our ratings on the Bloomberg Terminal and include them in its Data License and B-PIPE solutions for use across the enterprise is another important step in fostering greater competition in the ratings market,” said Vincent Georgel-O’Reilly, Chief Market Officer Credit Rating at Scope Group.

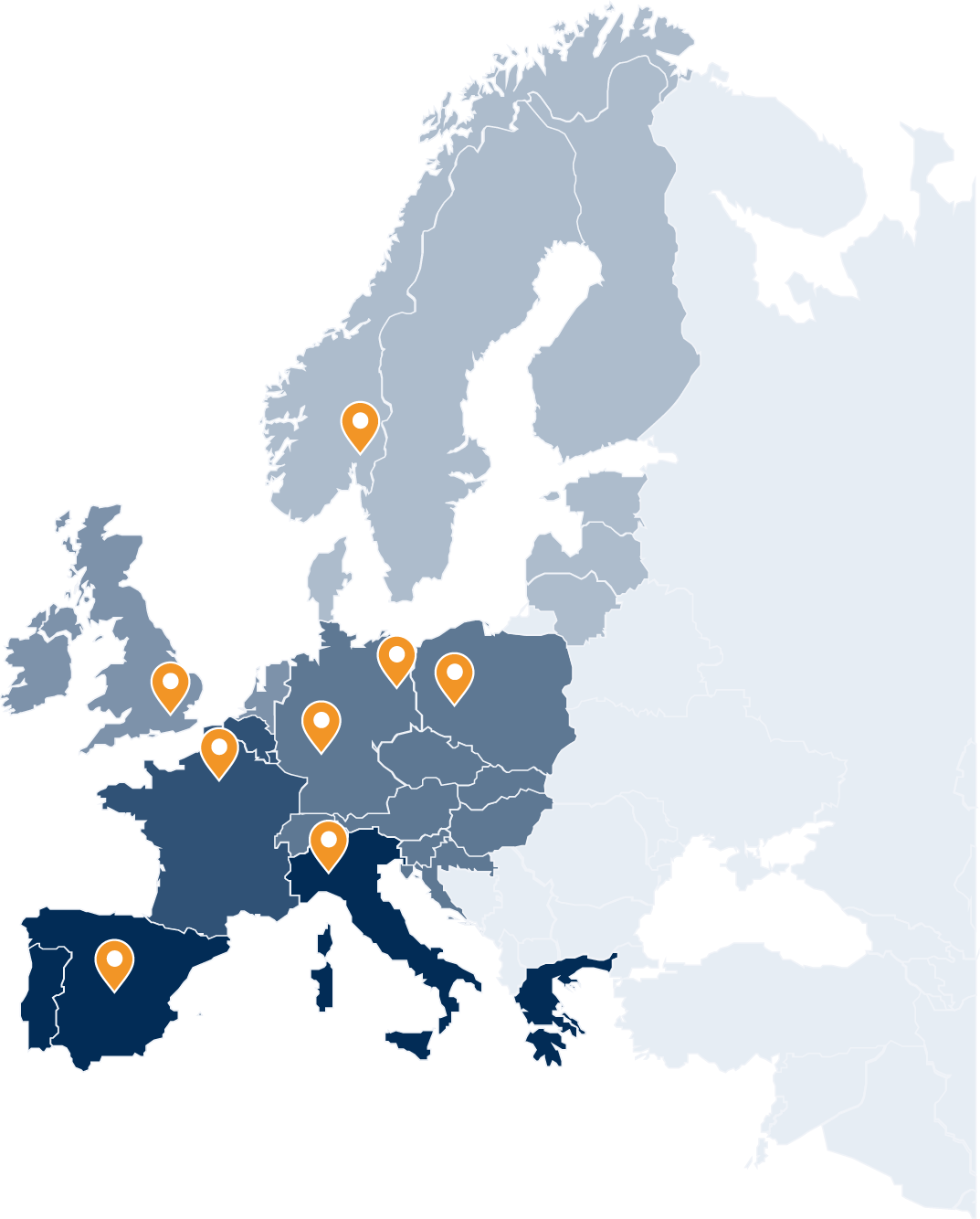

On Scope: Scope is the leading European credit rating agency (CRA) and the only European credit assessment institution accepted by the ECB in its credit-assessment framework. Scope’s distinctive approach provides opinion-driven and forward-looking credit analysis with a European perspective that recognises the local conditions – financial, political, regulatory, judicial and cultural – in which issuers operate.

On Scope’s rating coverage: As a full-service, multi-sector CRA, Scope rates more than 13,500 bonds from over 750 issuers. The amount of rated debt is worth more than EUR 43trn In Europe, Scope has the second largest rating coverage of public-sector issuers and the third largest for non-financial corporates (Source: ESMA market share report).

On Bloomberg and Scope: Scope’s public ratings and Scope-initiated open subscription ratings are now accessible on the Bloomberg Terminal, as well as via Bloomberg’s Data License and real-time market data feed, B-PIPE. Other types of Scope’s rating coverage – such as on-demand Open Subscription Ratings and Protected Subscription Ratings – remain available exclusively to subscribers via the Scope One platform and direct data feeds from Scope.